ULJK Group presents opportunity for Indian Investor to invest in EUR/USD through Liberalized Remittance Scheme (LRS).

Established in 1903,ULJK is currently in its fifth family era of serving the financial services community, has tied up with a leading Serbian based investment and brokerage firm for Portfolio/Fund Management Services.

“We constantly strive to anticipate the rapidly changing environment and develop services for investors to invest in new products globally.” says Mrs. Madhavi Vora, Chairperson, ULJK Financial Services.

Demonetization, the falling rupee and falling interest rates have forced HNI’s and institutional investors to diversify into different currency instruments such as USD/EUR denominated sovereign bonds to averse the currency risk.

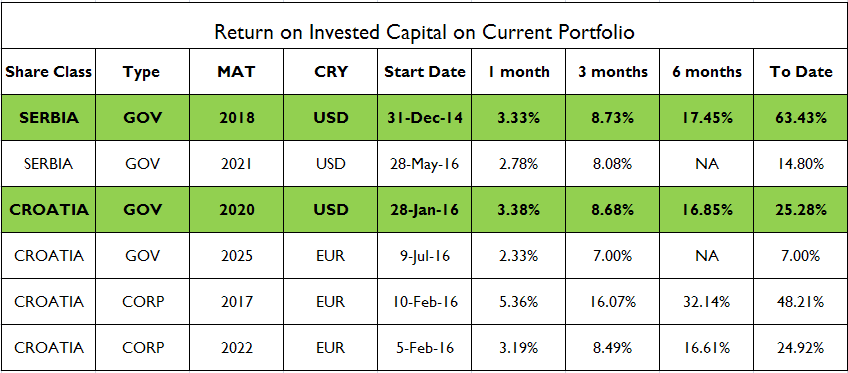

As showed in the fig. below, Serbian government bond with ULJK’S C1 strategy have returns of 17.45% in most recent 6 months, in like manner Croatian 2020 bond have given returns 16.85 % in most recent 6 months.

Return on invested capital on current portfolioThe investment model has been able to generate double digit returns in each of the last four years. “We anticipate the PMS returns northward of 13% annually in the coming years due to favorable bond yield calculations and low sovereign risk in the target investment geographies”, continues Mrs. Vora.

As shown in the figure, investing in USD in the past could have been lucrative and same is the situation now with the falling rupee. For instance, if invested in USD four years back, you could have earned approx 35% returns due to currency fluctuation.

USD/INRThe Indian bond market has fixed returns and does not get any refinance facility while investing in the rupee denominated bonds which can be done investing in USD/EUR. The Indian bond market are less liquid compared to USD/EUR denominated bonds and returns are also more than Indian bond market of 6.5%. Even the investors, would get favorable position of forex appreciation, currency and geographical diversification.

LRS is a window provided by the government of India to remit money across borders, without seeking specific approval. According to RBI rules, Indians can put up to USD $2,50,000 (INR 16 million) in a year per person in bonds outside India and exploit when Indian markets are so unstable.

The Eastern European countries have attracted lucrative investments from the Middle East and Far East Countries since they are issuers of USD/EUR bonds.

The investment strategy is based on taking advantage of the credit spreads of emerging market high yield bonds and current global refinancing rates. The fund manager invests in fixed income sovereign bond in most stable economies of Europe.